You enter into a long-lasting commitment once you sign on the dotted line for your mortgage. It can outlast the house itself or the owner. Planning and approval from the lender are necessary to sell a home and get out from under a mortgage.

There are several ways you can get out from under a mortgage you can't afford. Knowing your options and deciding what's best for your particular situation is essential.

Here are the most common ways buyers get out from under a mortgage they can't afford.

Please bear in mind, that while we guide you through some steps to getting out of mortgages, its important to understand what ties you may have with your mortgage lender. View our guide on collateral and the effects it may have on your mortgage.

Out of sheer denial, a lot of people lose their homes to foreclosure. Ignoring a foreclosure notice, sadly, will not make the issue go away.

As a matter of fact, the more you wait, the more you reduce the available choices. That's why you should contact your lender as soon as you get into trouble with paying the mortgage to see if you can sort out anything.

It would be best if you were willing to talk about why you can't afford the mortgage if the problem is just temporary, and your income details.

It can be a best-case scenario for lenders to help a borrower keep the property, particularly when the market might already be flooded with other foreclosed properties.

To speak to a housing counselor about your options, you can also contact the Consumer Financial Protection Bureau.

Borrowers adjust the interest rate and term of their mortgage while maintaining the original remaining principal amount. Instead of reducing or growing the mortgage balance, this option doesn't change it.

You can get out from under a mortgage if it's at a higher than the market rate or if you have a term that's longer than necessary. Say you have a 30-year fixed mortgage at 6.5%, and you can get a 30-year fixed at 4%.

In this case, you'd refinance to a lower rate. Or say you have a 15-year fixed mortgage, but you can get a 30-year fixed at a lower rate. You could refinance to a 30-year fixed.

A cash-out refinance is a mortgage refinancing alternative where an old mortgage is replaced with a new one with a more significant amount than owed on the previous loan.

It helps borrowers use their home mortgage to get some cash. If you want to get out from under a mortgage, you can always try to refinance it by taking cash out.

You can use the cash to pay off other debts or add it to your savings. You can also use the cash to pay off the mortgage you have at a lower rate.

If you have trouble with your mortgage payments, you can try to negotiate a loan modification. A loan modification is a modification made to the terms of an existing loan by the lender.

It can mean a reduction in the interest rate, an extension of the time for repayment, a different kind of loan, or a combination of the three.

A short sale means when a financially distressed homeowner sells their property for less due on the mortgage.

In this case, the third party is the buyer of the property, and the lender gets all proceeds from the sale. The lender forgives the difference or gets a deficiency judgment against the borrower, which requires them to pay the lender all or portion of the difference between the sale price and the mortgage's original value.

This difference must be forgiven in a short sale in some states.

You should try to sell your home for what you owe and walk away if you don't manage to sell your home for enough to pay off your mortgage.

If you sell your home for less than you owe, you're going to have to pay the difference in cash.

Foreclosure is the legal process whereby taking ownership of and selling the mortgaged house, a lender attempts to recover the money owed on a defaulted loan.

If a borrower misses a certain amount of monthly payments, default is usually triggered. Still, it can also happen when the borrower fails to meet other terms in the mortgage document.

A deed in lieu of foreclosure changes the property title from the owner of the property to their lender in return for the mortgage debt being relieved.

A deed in lieu of foreclosure is a possible option taken by a mortgagor or homeowner, usually to avoid foreclosure.

In the process, the mortgagor deeds the collateral property, which generally is the home, back to the lender serving as the mortgagee in exchange for the release of all obligations under the mortgage.

Both parties must agree voluntarily and in good faith. The homeowner signs the document, notarized by a notary public, and recorded in public records.

People temporarily in a poor situation can consider renting their home and living elsewhere and moving back when they can afford it again. It's a working approach in areas where rents are substantial and rental property is in high demand.

In this case, the homeowner becomes a landlord, which means that it's a different picture for insurance and taxes. If you are thinking about this alternative, check with your insurance company.

There are still possibilities if you have no place to sleep.

For preventing people from ending up on the streets, the National Coalition for the Homeless has programs, so give them a call to learn about emergency assistance programs in your area.

If you can't get help or find the resources you need in your community, consider moving to one where you can. There are several options available to borrowers facing foreclosure, but homeowners need to be informed, move quickly, and be proactive.

Borrowers should be on the lookout for anyone who tries to charge a fee, pressures them to sign over their deed, or attempts to collect mortgage payments.

Many scammers are trying to take advantage of struggling homeowners' desperation when it comes to foreclosure. Just know that if you can't pay your mortgage, there are some things you can do to make the best of a poor situation.

If you are looking for affordable places to Live in Alabama then check out this article

Selling a home is a major life change. Maybe you are moving into a bigger house after you have outgrown your starter home, or you are downsizing when your kids go off to college.

Or perhaps you are purchasing a house in a different part of the country as a result of a new job. You are wondering if there are tax tips for selling your house?

Whatever the reason, selling the place you call home is a big deal. But selling a home can be a particularly difficult task, especially when you factor in the numerous and unpleasant tax implications involved.

As a homeowner, it is important to understand how your taxes will affect if you sell your home. Before you pack up and move in, here is how putting your home on the market affects your tax return.

Despite most of the profits from home sales are now tax-free (if you qualify for tax exemptions), there are still steps you can undertake to increase the tax gains from selling your property.

Learn how to calculate your winnings, factor in your base, home improvements, and more.

If you are selling your main home, the tax law allows you a very generous exception for the profits you make. In fact, most home sales avoid taxation altogether.

So, when you sell your home, you will probably find that packing and unpacking in your new home will be a much more difficult task than calculating your income tax bill from the sale.

There is a good chance that you will not even have to report the transaction to the tax office. This guide explains what you need to know about home sales taxes.

We are here to help you navigate the rules and regulations, so you can feel more confident about the taxes you owe or even better should not.

You can exclude $250,00.00 if you are filing as single or married and filing separately and $500,00.00 if filing as married filing jointly from the profits of your property.

There are three main requirements that you must meet to qualify for the aforementioned tax break:

(1) You are automatically disqualified if:

(2) Ownership Test

You must have possessed the home for a minimum of two years out of the five years of the date you sold your property.

Example: If you lived in a house for ten years as your primary residence and then rented it out two years before selling, for example, you will still meet this test. But if you have owned a home for less time, you are not eligible for tax benefits

(3) Residence Test

This is simply if you have used the home as your residence for 2 out of 5 years.

Note: This means that secondary homes, such as holiday homes and net rental properties, are not likely to qualify for this tax break.

(4) The Lookback Test

If you have sold another house and took tax exclusions 2 years before you sold your latest house, you a not eligible. You can only take a tax exclusion every two years for each house you sell.

If you meet these criteria, you are eligible for the exclusion.

If you don't meet the criteria for ownership, residency, or the Lookback test a portion of your profit may still be tax-free.

The reduced exclusion allows you to claim some of the tax benefits, even if you do not meet all of the above requirements.

For example, if you only live in your home for one year, you can be exempt for as little as $ 125,000 from any profit you make from selling your home.

However, you must have a good reason to qualify for the reduced exception. Good reasons include

If you need to move to a new house because you do not have enough room for your growing family, the Internal Revenue Service still allows you to eliminate some profit it is just a little less than the complete exclusion sum.

Check publication 523 on page 6 to see the other reduced exceptions.

Remember that while you can use the exception any number of times during your lifetime, you can't use it more than once every two years.

Let's look at if you are required to report the gains or losses from the sale of your home. The rules here are pretty black and white. Check out our tax tips on selling your house!

You must report on your tax returns if:

You don´t have to report the sale of your home if:

For example, if your profit from selling your home is less than the exemption amount and you meet the requirements, you don't need to report your home sale on your tax return.

Note: If you get a form, even if you qualify for an exemption, it doesn't necessarily mean you have to pay taxes. However, this means that you will have to report the sale. To avoid receiving this form, you must confirm (usually when closing) that you meet the ownership, use, and time tests that we noted earlier.

Just make sure that you report the gains or losses if you are required, if you do not it will turn into a tax nightmare that you don´t want!

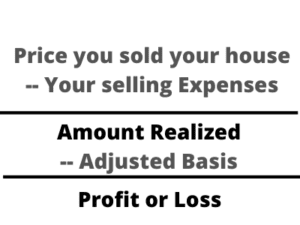

If you end up having to report your loss or gain on your tax returns then here is an overview of the process to help guide you through the process.

Note: that we are just giving you the overview and tax tips on selling your house, please seek a professional when figuring your loss or gain.

From the net sales proceeds, that is the sale price fewer selling expenses, including the real estate agent's commission and or other expenses, subtract the adjusted tax basis and you will either see a gain or loss. Here is what the figure looks like:

As you can imagine, capital improvements increase your basis or the amount of your capital investment in assets for tax purposes.

You can include some of the costs involved in the purchase and maintenance of your house. Let's look at some example that adds and subtracts your basis:

| Adds to Basis | Subtracts Your Basis |

| New Roof Central Air Conditioning Changing all electric wires in the home Damaged property restoration | Certain insurance deductions Some vehicle credits Depreciation Corporate distributions (nontaxable) |

Here is a list of closing costs/ settlement fees that you can factor into your basis:

Improving your home adds prolonged value to your house and can be added to the basis of your property. Here are some examples that you can factor into your basis:

While the guideline that allows homeowners to take up to $500,000 (married couples) of profit tax-free applies only to the sale of your principal residence, it has been permissible to extend the tax relief on a second real estate by making it your principal residence before you sell it.

If you happen to have another home, whether it is a vacation bungalow, a rental cottage, or some other dreamy escape, it is tricky to take advantage of the tax gain that makes it possible for married property owners to claim up to $500,000 of tax-free profits when they sell their main house.

To claim the benefit, you must own your second home for at least five years and must have lived in it for at least two of those five years. The years of personal accommodation do not need to be subsequent.

Due to that reason, some people prefer to convert rental real estate into their primary residences. This is a good tax tip for selling your rental house!

Otherwise, be prepared to pay a steep long-term capital gains tax. Interested in what capital gains tax rates are? Look at this table:

Tax Rate of Long-Term Capital Gains | Your Income | |

| 0% | $0 -$40,000 | |

| 15% | $40,001- $441,450 | |

| 20% | $441,451 or more |

Finally, be active throughout the year by making appointments with a tax adviser or CPA, starting tax conversations with your agent, and keeping receipts for all your real estate expenses, such as home improvements or renovations in a dry place, or turning them into digital copies.

Bring these papers with your newfound tax experience in tow so you can feel empowered when you apply in the spring-regardless of the outcome.

While the tax implications of selling a home are relatively black and white, meaning you will or will not have to pay taxes on the profits you make after closing, the sensitivity of this issue stems from the strict time frames and thresholds that the IRS applies.

While the best real estate agents should have a basic understanding of the financial implications of selling a home, you should discuss most of your tax issues and concerns with a tax adviser.

Choose a professional who has the most up-to-date information for any given year and whom you trust to discuss your situation openly and freely.

Anyone thinking of refinancing their house should talk to a minimum of 3 lenders before locking a rate.

The difference between the best loan terms and worst loan terms means that over the lifetime of the loan, a homeowner could save tens of thousands of dollars on a six-figure home and hundreds of thousands of dollars when buying a home worth over a million dollars.

Refinancing with the lowest interest rate may not always be the best financial decision for a homeowner. To secure a very low-interest rate, a lender will require you to purchase points to buy down the rate.

When shopping rates, homeowners need to focus on reducing the overall cost for a loan based on how long they plan to own the home.

If the home will only be held for a few years, a loan with a higher interest may make more sense.

When comparing loan terms, a good rule is to compare the totals of the closing costs with the sum of the interest paid over the number of years the home will be owned.

In a cash-out refinance, a homeowner is able to withdraw cash by adding the amount withdrawn to the current principal balance of the loan.

A no cash-out refinance means the borrower only refinances the interest payments on the current principal balance of the loan. A cash-out refinance comes with higher risk, because the loan terms have a higher interest rate and higher monthly mortgage payment.

Refinance closings costs are all the different charges and fees required to refinance the loan. A few closing costs include taxes, application fee, a possible origination fee, appraisal fee, inspection fee, title search, and title insurance.

To see a detailed list of costs, ask each lender for a loan estimate as every lender has slightly different terms, which may or may not include certain fees. As a rule of thumb, the Federal Reserve (https://www.federalreserve.gov/pubs/refinancings/#cost) lists refinance costs on average at between 3-6% of the loan amount.

However, the best way to get an accurate comparison of costs is to get a loan estimate from each lender.

With mortgage rates at record lows, refinancing is almost always a good decision as long as you take into account closing costs, the type of interest rates you qualify for, and how long you plan to own your house.

The savings from a 0.5% interest rate drop will often break even with refinancing closings costs between 5-10 years. A 1% interest rate drop can break even in 2-3 years.

Also, don't hesitate to ask the lender to help you understand your true break-even horizon when deciding to refinance.

If you're planning to hold onto your home for longer than 3 years, refinancing to save a 1% interest rate on a 15 or 30 year fixed loan is almost always worthwhile.

It's basically free money. However, there are reasons why refinancing may not make sense. If you are planning to sell your home next year you probably won't recoup the closing costs.

Also, if the loan terms are with an ARM that has a fixed interest rate followed by a floating rate, it is highly likely after the maturity of the fixed-rate period, the floating interest rate may be much higher in the future.

Understanding your break-even timeline will help you know if it is worth refinancing to save $100 per month.

To calculate the number of months before you break even, take the total closings costs and divide by a hundred to get the total number of months.

For example, if closings costs are $4800, then it will take 48 months or 4 years to break even. Once you hit the break-even point, your new loan is now costing you less than your old loan.

If you are close to paying off your loan, refinancing is a very bad idea because you've reached a point where you're paying more towards principal and less towards interest.

Refinancing your loan means you'd reset the amortization schedule and pay more interest than the principal.

Refinance rates have been trending down, but closing costs have been trending up due to the flood of demand from people taking advantage of lower rates.

In today's market, it is more important than ever to shop with multiple lenders to get the lowest overall costs when refinancing.

Refinancing with your current lender can be cheaper because you may be able to save on certain fees, such as an application fee or appraisal costs.

Make sure to ask your lender if these fees are waived because not all lenders will waive these fees.

When considering offers, make sure to talk to other lenders, because another lender may give you a lower interest rate, which could be worthwhile even with higher closing costs.

If you're thinking of refinancing your houses, call lenders now because these low-interest rates won't last.

If you could save tens of thousands of dollars by making a no-obligation phone call, why wouldn't you do it? It's a no-brainer.