Are you looking for simple and easy tips for making home-buying process simple ? Purchasing a house can be one of the most exhilarating experiences in life, but it can also be one of the most daunting. With myriad factors to consider and numerous steps to navigate, the home-buying process can sometimes feel overwhelming. Yet, it doesn't have to be that way.

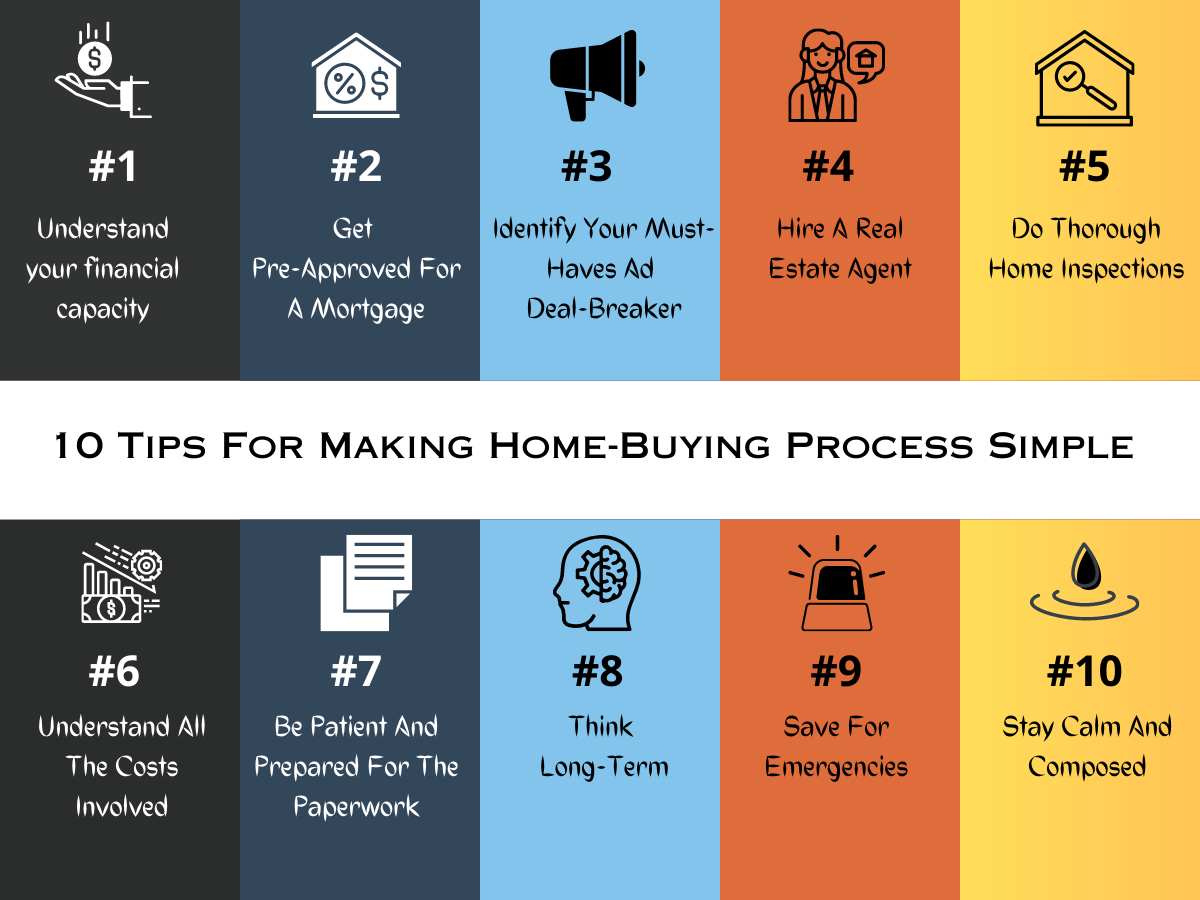

In this article, we'll provide ten (10) helpful tips designed to simplify the home-buying process, enabling you to navigate your way to your dream home confidently. Whether you are a first-time buyer or an experienced homeowner looking for a change, these practical pointers will streamline your path to homeownership. Let’s start!

Before embarking on the home-buying journey, evaluating your financial standing is crucial. This involves assessing your income, current expenses, debts, and savings to determine how much you can reasonably afford to spend on a new home.

Remember, the general rule is that your monthly mortgage payment should not exceed 28% of your gross monthly income. By setting a realistic budget upfront, you avoid the risk of financial strain or overcommitment down the line.

Securing a mortgage pre-approval before you start your home search is a strategic move. This process involves a lender evaluating your financial health to determine how much they will lend you. A pre-approval provides a more concrete idea of your price range, helping you focus your search on homes within your budget.

More than that, it serves as a testament to sellers that you are a serious buyer with the financial backing to follow through on your offer. This can be particularly advantageous in a competitive market where multiple offers are common. It's crucial, however, to remember that pre-approval is not a guaranteed loan.

It is conditional on your financial circumstances remaining consistent and the property you ultimately select meeting the lender's requirements, including a sufficient appraisal value. As such, it's advisable to maintain your financial stability throughout the home-buying process to ensure a successful final loan approval.

It's crucial to be clear about what you're seeking in a prospective home. Before embarking on your house hunt, create a list of must-haves—features that are non-negotiable—and deal-breakers that would deter you from purchasing a property.

This could range from the size of the home, its location, how close it is to amenities or work, the safety of the neighborhood, to the quality of the local school district. This list will serve as a guide to narrow down options and keep your search focused. However, maintain some flexibility.

Finding a property that meets all your criteria may be difficult, and a degree of compromise can open up more potential homes without sacrificing your most important needs.

Working with a skilled real estate agent can greatly ease the home-buying journey. These professionals bring a wealth of knowledge about the housing market, and their experience in sourcing suitable properties and handling negotiations can be invaluable.

An agent can help you navigate the myriad steps involved in buying a home, from initial browsing to making an offer and closing the deal. They can also provide useful insights about potential areas and properties based on your preferences.

When selecting a real estate agent, ensure they understand your requirements and priorities and that they are someone you can trust and feel comfortable with. A strong, collaborative relationship with your agent will contribute significantly to a smoother, more successful home-buying experience.

A comprehensive home inspection is a must. This step uncovers any hidden issues, such as structural defects or outdated systems, that could become costly problems. Engaging a professional inspector can save you from unexpected headaches and expenses.

In some cases, identified problems could be deal-breakers, enabling you to make an informed decision about whether or not to proceed with the purchase. Remember, hiring a professional inspector pales in comparison to the potential costs of unforeseen repairs or renovations. Consider it an investment in your peace of mind and the longevity of your potential new home.

When you buy a home, the financial commitment certainly doesn't stop at the purchase price. There are many additional costs that buyers sometimes overlook in their initial calculations. These include fees for home inspections, which are vital to ensure the home doesn't have hidden issues, and closing costs, which can include loan origination fees, title insurance, and more.

It's essential to have a plan in place for saving money for a house to cover these various expenses. Additionally, you'll need to account for the expenses associated with moving into your new home. Finally, immediate repairs or renovations may be required to make the house fit your living standards. These could range from minor cosmetic upgrades to significant overhauls of key systems like plumbing or electrical.

Understanding and accounting for these costs upfront can help you set a realistic budget and ensure that you're financially prepared for the true cost of homeownership.

Here’s a more comprehensive guide on this topic: How much are closing costs in Alabama?

The home-buying process involves considerable paperwork, spanning from the initial offer to the closing documents. Ensure you comprehend each document before signing, and don't hesitate to seek clarification on any points of confusion. Patience and diligence are key during this stage.

In this paperwork-heavy process, don't be afraid to ask questions if something isn't clear to you. A trusted real estate agent or a real estate attorney can prove invaluable in explaining the sometimes complex language found in these documents. They can help you understand the fine print so you know what you're signing.

Remember, when it comes to your future home and such a significant financial investment, there are no silly questions. Patience, diligence, and a desire to understand can help you navigate the paperwork seamlessly and make a well-informed purchase decision.

Homeownership is a considerable long-term investment beyond just providing a place to live. It significantly impacts your financial status and lifestyle. It requires thinking ahead, considering your current needs and future possibilities.

Consider your life a decade from now. Plans for family expansion or potential relocations for work could influence the type of home you need. Even lifestyle changes like adopting sustainability practices, could dictate your home choice.

In essence, homeownership should be viewed as a long-term commitment aligned with future plans. This approach ensures a suitable choice that accommodates both your current situation and future changes, making it a rewarding investment.

Embracing homeownership also means preparing for unexpected costs that inevitably come with maintaining a property. These could be immediate needs, like repairs to a leaking roof, replacing a faulty appliance, or regular maintenance activities such as servicing the HVAC system or repainting the exteriors.

These costs can add up quickly and are often unpredictable. That's why it's prudent to establish an emergency fund specifically for your home. This fund should be separate from your regular savings or checking account, providing a financial safety net for unforeseen home-related expenses.

By setting aside a small amount each month into this fund, you'll have the peace of mind of knowing you're prepared to tackle any home maintenance or repair challenges that come your way.

Home-buying can be a lengthy and sometimes stressful process. However, keeping calm and maintaining a composed mindset can make the journey more manageable. Remember, patience, preparedness, and informed decision-making are the cornerstones of a successful home-buying experience.

These ten tips we've shared are designed to shed light on key aspects of the home-buying process, helping to equip you with the knowledge and confidence you need to navigate the journey successfully. From understanding your financial position to doing a thorough research and surrounding yourself with the right team of professionals, each step is crucial in making the process as simple and stress-free as possible.

Remember, buying a home is not just a financial commitment, it's a personal journey and a major life milestone. Following these tips will prepare you to make informed decisions and pave the way to your dream home. Happy house hunting!

When it comes to hiring a contractor for a home renovation or construction project, the natural inclination is to choose the lowest bid. It's easy to see the appeal - saving money on a project is always enticing. However, there are several reasons why choosing the lowest bid may not always be the best decision.

In this article, we'll explore the reasons to be wary of low contractor bids, the potential risks of accepting them, and why they may not be the bargain they appear to be.

When evaluating contractor bids, it's essential to consider more than just the quoted price. A key factor to examine is whether a contractor has adequate insurance coverage and licensing.

Inadequate insurance exposes you to financial liabilities if accidents or damages occur during the project. For instance, if a worker sustains an injury on your property or damages your home, you could be held responsible for the associated expenses if the contractor's insurance is insufficient.

Further, proper insurance and licensing are crucial in resolving disputes between homeowners and contractors. If your contractor lacks insurance or a valid license, your legal options for seeking compensation or holding them accountable for issues such as poor workmanship, delays, or other problems may be limited; having to sue for property damage is a particularly miserable way to have your renovations grind to a screeching halt.

As you evaluate contractor bids, it's crucial to consider the potential risks associated with inadequate insurance coverage and licensing. Always verify that your chosen contractor meets all requirements before beginning any project.

By doing so, you can enjoy a high-quality, worry-free renovation or construction experience while safeguarding your investment and property value.

While the use of subpar materials or construction techniques is considered a cost-cutting measure and may lower the initial cost of the project, it can lead to long-term issues and added expenses. Thus, it's essential to know the potential risks associated with subpar materials and construction techniques when evaluating low contractor bids.

Using inferior materials or employing substandard construction techniques can significantly impact the durability and lifespan of your project. Subpar materials and construction techniques can also result in safety hazards or code violations, putting you and your family at risk. Inferior materials may not provide the necessary structural support, while poor construction techniques can lead to weak joints, leaks, or even collapses.

Choosing a contractor who uses high-quality materials and employs proven techniques may be a more cost-effective decision in the long run, ensuring a durable, safe, and valuable finished project.

When evaluating low contractor bids, it's crucial to consider the potential risks associated with inexperienced or unqualified labor. Prioritizing a contractor with a skilled and qualified workforce may be a wiser investment in the long run, ensuring a high-quality, safe, and valuable finished project.

Inexperienced or unqualified laborers may lack the skills and expertise needed to execute the project efficiently and to a high standard. This can result in compromised workmanship, necessitating additional repairs, alterations, or even complete rework. Poor workmanship can also lead to project delays and mismanagement.

Moreover, inexperienced or unqualified laborers may be unaware of safety protocols and regulations, increasing the risk of accidents or injuries on the job site. As the homeowner, you could be liable for accidents or injuries due to inexperienced workers' negligence.

Therefore, focus on the contractor's experience, qualifications, and track record of successful projects to maximize your investment and achieve a satisfying construction experience as you review bids.

To win a contract, some contractors may underestimate the amount of time required to complete the project. While this approach may seem appealing initially, it can lead to many problems and delays during construction.

When contractors commit to an unrealistic timeline, they may rush the work to meet the deadline. Rushed work can result in compromised quality, as workers may cut corners or make mistakes due to the pressure to finish quickly. This can lead to a need for future repairs or even jeopardize the project's structural integrity.

Project delays can frustrate homeowners, as they disrupt plans and extend the time it takes to enjoy the finished project. Delays can also have financial implications, as extended timelines may increase costs for both the contractor and the homeowner.

As you review low contractor bids, be cautious of unrealistic project timelines and potential delays. Prioritize contractors who provide realistic timelines and have a track record of completing projects on time and within budget. Doing so can minimize frustration, financial impact, and risks associated with rushed work, ultimately leading to a more successful construction experience.

Comprehensive warranty coverage offers protection against defects in workmanship and materials, ensuring that any issues that arise after project completion are addressed promptly and at no additional cost to the homeowner. A contractor who offers limited warranty coverage may leave you vulnerable to unexpected expenses if issues arise after the project is completed.

A contractor who offers comprehensive support will be available to address any questions, concerns, or problems that may arise after the project is completed. In contrast, a contractor who provides limited support may be difficult to reach or unwilling to address issues, leading to dissatisfaction and frustration for the homeowner.

Choose contractors who offer comprehensive warranties and support to ensure that any issues that arise after project completion are addressed promptly and effectively. Doing so can minimize the risk of unexpected expenses and frustration, leading to a more successful construction experience and long-lasting satisfaction with the completed project.

Unethical business practices can include dishonesty and misrepresenting project details, such as underestimating the scope of work or overpromising deliverables. Contractors may also misrepresent their qualifications, experience, or the quality of materials they plan to use. These deceptive practices can lead to project delays, poor workmanship, and potential legal issues.

Another unethical business practice is the exploitation of workers. Contractors offering low bids may cut costs by underpaying workers, hiring unqualified or inexperienced labor, or ignoring worker safety regulations. These practices not only harm the workers themselves but can also negatively impact the quality and safety of the finished project.

Contractors who engage in unethical business practices create unfair competition within the industry, making it difficult for honest contractors to compete on a level playing field. This can lead to market distortion, as homeowners may be more likely to choose low-priced contractors without understanding these unethical practices' potential risks and consequences.

Prioritize contractors who are known for their ethical conduct and commitment to quality work. By doing so, you can minimize the risk of negative consequences associated with dishonesty and exploitation, leading to a more successful construction experience and a better overall outcome for your project.

While it's natural to be drawn to low contractor bids, it's important to remember that the lowest bid doesn't always equate to the best value. Consider the potential risks outlined above before making your decision, and ensure that you're selecting a contractor capable of delivering high-quality work at a fair price.

By doing your due diligence and thoroughly researching each contractor, you can make an informed decision that will result in a successful and satisfying project.

The process should be reasonable when deciding whether to sell your house in Huntsville. If it isn't that exorbitant, selling your home won't take a year or more. However, it is visually appealing, resulting in a stampede of eager consumers.

If you plan to sell your house in Huntsville, buyers have a strong interest in all things digital. Using walk-through videos of the property to promote will allow you to reach a broader audience.

On the other hand, these movies are more transparent than photographs. This shouldn't deter you from choosing the video option since it's far less expensive than the audio option.

If you're looking for a real estate agent, there are plenty of options to list your home on the Huntsville MLS for a small price.

Your home will be seen by all the real estate agents rapidly, so be ready to pay those "buyers' agents" a 2-3 percent buyers broker charge should you want to employ their assistance in finding a buyer.

Post ads in the local paper put up signs along the highways, and host an open house to promote your business.

If you wish to purchase or sell your home in Huntsville, you'll need an agent to help you get the best possible outcome. Agents in real estate may work for the buyer or the seller, depending on their specialty.

No matter who hires them, a real estate agent represents the party paying the fee: the buyer or the seller. There are several ways real estate brokers interact with the general public and their customers.

Real estate agents do all of the work for you, and use their expertise to price, promote and sell homes- so you don't have to give up your life to sell your house fast. All of the work is taken care of by them. However, there is a cost to using this service.

In most circumstances, a standard real estate commission of 6% is well worth the benefits of working with an agent. But agents don't have the same skill set, and an inexperienced agent may sabotage your sale by pricing the home excessively high or excessively low.

A real estate agent may help you find a buyer for your home by listing it on the market and networking on your behalf. Make sure you don't foul any local rules and regulations by hiring a local legal professional.

They also know the local property market, so they can help you price your house and make it more attractive to buyers.

Additionally, there are certain drawbacks to dealing with a real estate agent when selling a home. Commissions might reduce your earnings, which can be a drawback for some people.

They may make you agree to offer your home for a greater price than you want. If they don't know how to sell a property, they may not be able to achieve the greatest possible price.

Furthermore, speedy sales are impossible to guarantee. It all relies on the market and the right moment. An agent may perform all the marketing strategies to make your listing more appealing, but there is no guarantee that potential buyers will find it.

Open houses and other types of showings to prospective purchasers might cause some disturbances to your routine.

The disadvantages of selling your home without the assistance of a real estate agent include the fact that you will be responsible for all of the work and will lack the expertise of a professional. In addition, you'll be responsible for all of the marketing, showing scheduling, and documentation.

The phrase "for sale by owner" (FSBO) refers to homes being sold without a broker's help in the real estate industry. The property owner will put it on the market and make an effort to find a buyer.

People who choose to sell their homes this way do so because they believe they can receive a better price for their property if they handle everything themselves. In other cases, this is not the case.

Selling your house FSBO might save you a significant amount of money in the commission that would otherwise be paid to a real estate professional. Your house may also sell quicker since you'll be the only one looking to buy it.

In selling your own house, you'll be responsible for most labor. Listing and showing the property to prospective purchasers will need your time and effort.

Additionally, you'll have to devote time to the negotiations and the required documentation to make the transaction a reality. Selling a house FSBO means being honest about what you may expect to get.

A realtor's fee may be avoided, but you may not obtain as much money for your property as you would have with one if you do it yourself.

Many individuals who own their own houses find themselves in the position of needing to sell them. When a home is up for sale, they will typically erect a sign in the yard.

All around the nation, these placards may be seen in different locations around the neighborhood.

In many cases, homeowners decide to sell their homes independently. Selling without a realtor might save you money and help you sell your property more quickly.

However, the disadvantages include doing most of the work yourself and earning less money for your property than with a realtor.

Everything from cleaning and staging to pricing, marketing, and negotiating with all bids will fall on your shoulders if you decide to sell your house in Huntsville on your own.

You'll save money by selling your home yourself rather than paying a real estate agent's fee.

Selling a property on your own might be complicated because of a lack of experience with pricing. Even though you've lived in the neighborhood for a long time, remember that real estate brokers have gone through extensive training to become experts in the area.

You may have seen signs that read, "We buy Huntsville houses for cash in your area." These fast-cash home purchasers might give you a taste of what it's like to sell your property quickly for quick money in the past.

You immediately think of two words: quick and convenient.

Cash homebuyers often make the same day they examine properties. Because they don't have to wait for finance, cash homebuyers may close in as little as seven days.

The term "cash house buyer" refers to those who pay for their homes in cash rather than using a mortgage.

Homeowners who pay cash have a larger purchasing power than those who must get financing. As a result of lenders tightening lending criteria and making it more difficult for prospective homebuyers to obtain the funding they require in today's real estate market, this is especially true today.

Cash purchasers may not be as ready to compromise as those relying on a loan. They may not be as willing to bend to your needs.

Working with cash buyers has two key advantages: convenience and quickness. The house is purchased "as-is," so there is no need to do any repairs or improvements to get out of the house swiftly.

A cash buyer might potentially leave money on the table, but the benefits outweigh the drawbacks for those who prefer this payment method.

A cash buyer may also assist in reducing holding expenses (mortgage, insurance, utilities, etc.) that must be paid while waiting for a suitable buyer to come along.