Foreclosures are difficult to work through. But don't worry, there are a few ways to stop foreclosure immediately.

In a perfect world, your job is secure, and your health is fantastic. Then the unthinkable happens and you're losing your home. We understand how devastating facing foreclosure can be.

These unfortunate events can affect how you pay your bills, including your mortgage. But whatever your setback is, we can help!

In this article, we will help you understand what a foreclosure is and the process. Then we'll discuss how to avoid foreclosure and how you can stop foreclosure proceedings. As we move forward, we'll explain how we can help get you back on the right track.

WHAT IS A FORECLOSURE?

A foreclosure is when a homeowner falls behind on making their mortgage payments. If the house doesn't sell at auction; it becomes a property of the mortgage company.

Home buying is a gigantic step and nothing beats providing shelter for your family. Most home buyers don't have the full amount to pay for it upfront. So they choose a monthly payment method and apply for a home loan through a lending company.

A lending company is a bank, credit union, or financial institution that lends you the money to buy your home. When you're ready to close on the home, you will sign the lender's mortgage note.

This note states you agree to pay the loan back over a specific period. This agreement also states that the lender is the official owner until you pay the loan back.

If you miss your monthly loan payments, the lender will take your home as collateral and then auction it off. This is foreclosure.

WHAT IS THE FORECLOSURE PROCESS?

Each lender has a different policy on how many months you can miss. It can be as few as two months late. However, according to the Consumer Financial Protection Bureau, 120 days late is common.

When you exceed their late payment threshold, the lender records a public notice. They report this public notice called a Notice of Default or NOD. A NOD is a record that shows you have defaulted on your mortgage.

Next, they give the notice to you or post it on your door depending on state law. This notice is a warning to let you know that you are heading towards foreclosure.

There is a grace period where you can make a payment arrangement with the lender to pay the amount you owe. This grace period is a pre-foreclosure. If you pay off the amount agreed upon, the foreclosure ends.

If you can't work out negotiations with your lender and can't pay, the house goes up for auction. At the auction, the highest bidder will get the home.

If the bidder does not buy the home by the end of the auction, it will become bank-owned property or real estate owned. These properties are sold by a local real estate agent on the open market.

But if the foreclosure process has started, can you stop a foreclosure? Next, we'll talk about how to stop foreclosure auctions immediately.

HOW TO AVOID FORECLOSURE

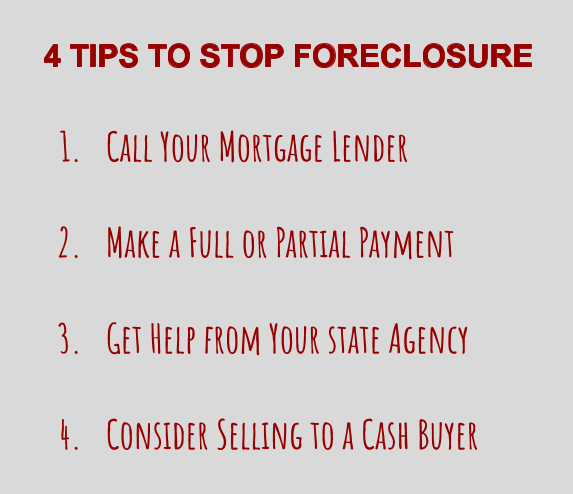

Here are a few tips to avoid foreclosure. If you see a mortgage payment issue in the upcoming future, call your mortgage lender immediately.

This is the best among the foreclosure prevention options.

Even if only one month's mortgage payment could be late, contact your lender

immediately. Contacting them early as possible before the first late payment is the best thing you can do. Avoiding your lender is the worst thing you can do.

Life happens, and sometimes payments become past due. Your lender provides loans to many homeowners. They hear many reasons homeowners could be late.

If you don't have the full payment, contact them and pay what you can. Give them as much incentive to work with you as possible. If you can't afford to pay anything make sure you tell them. You want to be as upfront and honest with your lender as possible.

If they can't seem to help you with options, you can get help through an MHA program.

The Make Home Affordable program is a modification program. This program provides free advice from counselors who can tell you your options.

Also, be sure to contact your state's housing agency. They might offer a housing counseling program in avoiding foreclosure like MHA does.

HOW TO STOP A FORECLOSURE AT THE LAST MINUTE

Did you know you can stop foreclosure? If you know your options, mortgage relief is possible.

- Always contact your lender to address any issues. Most mortgage lenders would rather work something out than take your home from you.

- Contact your state's housing agency. A housing counselor can help walk you through most of your options. Some federal laws can protect homeowners from foreclosure. If you feel this applies to you, contact foreclosure lawyers. They can give you legal advice.

- A mortgage modification might be a suitable option. If you're an immediate foreclosure risk, consider it. A loan modification is an agreement of terms outside of your original loan contract.

- Refinance your mortgage. First, you must qualify. If you take the loan, the terms of your original loan changes. You can also consider a repayment plan, a reinstatement, or a forbearance. Contact your lender to see if you qualify.

- Sell your home. You can sell your home for cash. If your house needs home improvements, that's ok. You can still sell your home in its current condition. Avoid the hassles and sell your home quickly.

- Bankruptcy. Filing for bankruptcy should always be a last resort if you need to take legal action. While bankruptcy will stop foreclosure in its tracks, it's only buying you more time. So the headache will continue.

Conclusion

Going through a foreclosure can be tough. Remember that many people go through this and that you have options. If you don't know what's right for you, reach out to your state's housing agency.